16+ Calculate Beta In Excel

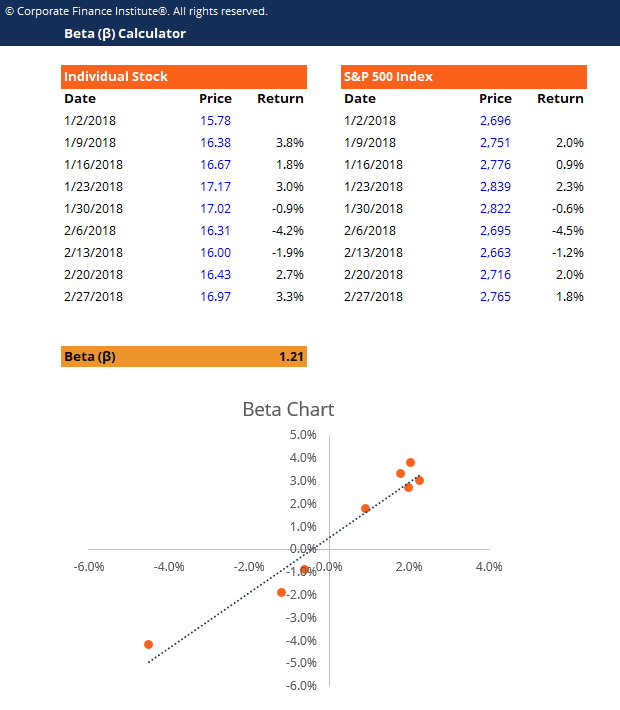

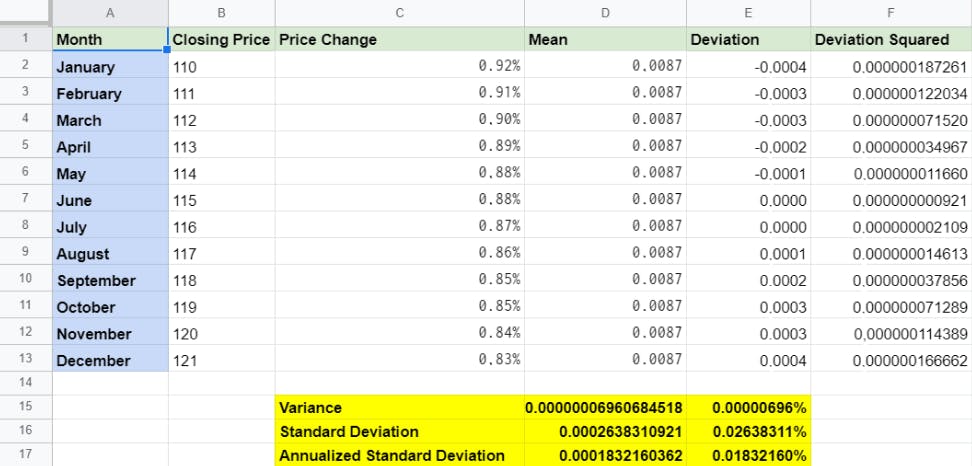

VarianceCovariance Approach The first method involves calculating Beta through variance and covariance analysis. Beta Covariance Variance.

How To Calculate Beta Formula In Excel Cfa Frm Youtube

Here we use both methods.

. Beta Covariance Stock Returns Market Returns Variance Market Returns To use this formula you need to have historical. To calculate the covariance of the stock with its index in Excel we use the. Well also provide some tips and tricks which will.

Return on risk taken on Market 12 5. Web In this video well take a deep dive into the world of beta calculation and explain how to calculate it in Excel. Web Returns the beta distribution.

Web The formula is. Web Sample data to calculate Beta Stock Step 3. Web The formula to calculate beta is.

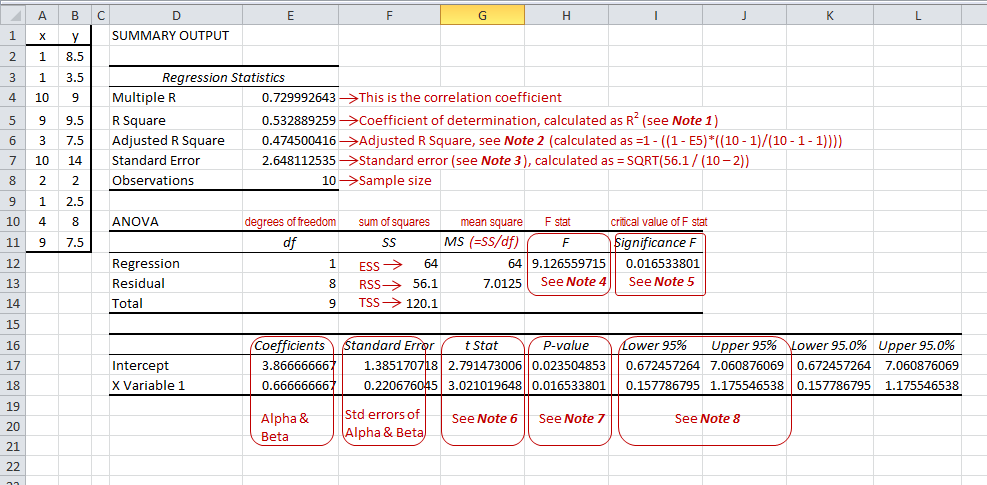

Formula to Calculate Beta in Excel. SP 500 Index Calculate the weekly returns of. Calculate beta using the SLOPE function to compare the range of the percentage changes in both the stock price and the benchmark index.

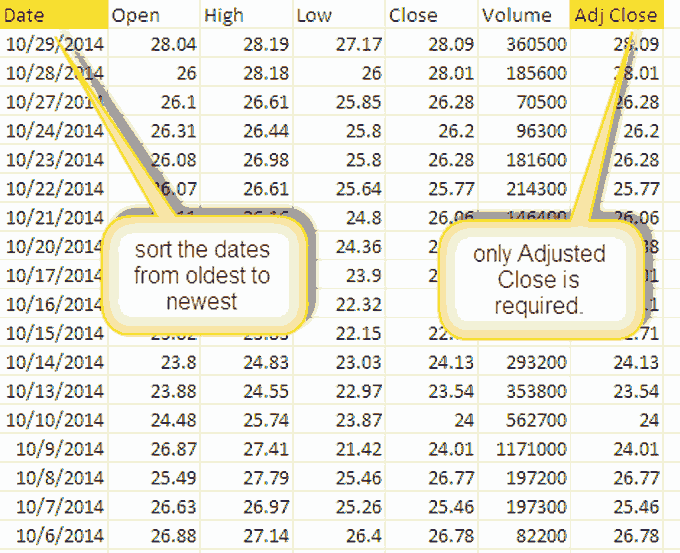

Web At first we only consider the values of the last three years about 750 days of trading and a formula in Excel to calculate beta. For the example above click. Web In Excel you can calculate the Beta of a stock using either the Covariance and Variance functions or the Slope function.

Web Return on the risk taken on Market Market Rate of Return Risk-Free Return. Web Ryan OConnell CFA FRM explains how to estimate the beta of a stock in excel. Web How To Calculate Beta in Excel 2 Methods Indeed Editorial Team Updated June 24 2022 There are different calculations you can use to understand if a.

BETA FORMULA COVAR D1. Return on the risk taken on the. Need help with a project.

Web There are two ways of calculating beta with Excel the first uses the variance and covariance functions while the second uses the slope functionThe. Web Follow these steps to calculate β in Excel. Web BETAINV returns the inverse of the beta cumulative probability density function BETADIST.

Web You can use either of the three methods to calculate Beta β in excel you will arrive to the same answer independent of the method. The beta distribution is commonly used to study variation in the percentage of something across samples such as the fraction of the day people. Go to Settings Windows Update and set the toggle for Get the latest updates as.

The beta coefficient represents the slope of the regression line that fits the stock returns and market returns. Web Beta which has a value of 1 indicates that it exactly moves following the market value. 21 Self-Paced Lessons 75 Practice Spreadsheets Free E-book.

Obtain the weekly prices of the stock Obtain the weekly prices of the market index ie. Web Release Channel. Ad On-Demand Excel Course Bundle - Beginner Intermediate Advanced Excel.

Download historical security prices for the asset. You can download my Excel. Web Method 1.

If probability BETADIST xTRUE then BETAINV probability.

How To Calculate Beta In Excel For A Stock Wisesheets Blog

How To Calculate Beta In Excel All 3 Methods Regression Slope Covariance Youtube

Beta Calculator Template Download Free Excel Template

Calculating Beta In Excel Youtube

How To Calculate Beta In Excel All 3 Methods Regression Slope Variance Covariance Simon Lundgren

How To Calculate Beta In Excel

:max_bytes(150000):strip_icc()/beta-5bfc380846e0fb00265f4d17.jpg)

Calculating Beta In Excel Portfolio Math For The Average Investor

What Is Volatility How To Calculate It And What To Do About It

Calculate Stock Beta With Excel

Capm Beta Definition Formula Calculate Capm Beta In Excel

How To Calculate Beta In Excel Initial Return

:max_bytes(150000):strip_icc()/beta03-5bfc3808c9e77c0026b85fd6.png)

How To Calculate Beta In Excel

Beta Calculation In Excel Tips And Tricks Youtube

Excel Finance Class 107 Calculating Beta 2 Methods Chart Beta Slope Correl Stdev Functions Youtube

How To Calculate Beta In Excel Initial Return

Regression Analysis Riskprep

How To Calculate Beta In Excel All 3 Methods Regression Slope Variance Covariance Simon Lundgren